Accounting for Small Businesses: A Comprehensive Guide to Financial Management

These statements are designed to document your business’s income and expenses for outside parties, including investors, lenders and creditors. When a business expense gets lost in your personal account and you don’t claim it on your tax return, that’s a tax deduction you’re missing out on. And if your CPA has to spend time separating your personal expenses from your business expenses, you’ll end up paying them more in accounting fees. If it’s tax season, when CPAs are the busiest, you may even run the risk of not being able to file on time. If you are a small business, chances are you don’t actually need to hire an accountant. You can use online accounting software to automate most of your accounting tasks, at a fraction of the cost of an accountant or a CPA.

Accounting vs. Bookkeeping

You can learn a lot about how to do accounting for small businesses just from browsing the internet. But nothing beats up-front, personalized advice from https://www.business-accounting.net/what-are-cost-accounting-formulas/ a certified professional—in this case, a bookkeeper, accountant, or CPA. Bookkeepers, accountants, and CPAs all bring something different to the table.

Choosing an Accounting Method

- Small business accounting mirrors this definition, but usually pays special attention to even the smallest details, since for most small businesses, every dollar counts and needs to be noted.

- When setting up a small business accounting system, you need to choose a method of recording financial transactions.

- Managing business finances doesn’t have to be the bane of your professional existence.

- Similarly, whenever you make an expense, the journal entry is automatically created, and it is mapped to the correct ledger account.

- Moreover, efficient bookkeeping strategies can help you stay out of trouble with the IRS.

Accountants calculate cash flow by making adjustments to a business’s income statement. Through addition and subtraction, bookkeepers remove non-cash items and transactions from the net income. Components of a cash flow statement include operating activities, investing activities, and financing activities. When you first start your small business, you’ll likely have to take on many day-to-day administrative tasks yourself, including accounting. Knowing how to track and project your business income and expenses are important skills for business success, so it’s important to familiarize yourself with the fundamentals of accounting.

Brex’s compliance head has left the fintech startup to join Andreessen Horowitz as a partner

If you want to accept online or credit card payments, you can use either Stripe or Paypal. Stripe allows you to directly integrate any application for tracking invoices, expenses, and more. Be sure to include an “aging” column to separate “open invoices” by the number of days a bill is past due. The beginning of the month is a good time to send overdue reminder statements to customers, clients, and anyone else who owes you money.

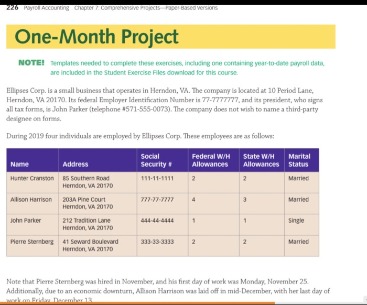

All employees must fill out an I-9 and W-4 form upon employment for tax purposes. These documents provide accurate wage reporting, along with Social Security and Medicare benefits. Excise taxes are specific to certain industries and uses outlined by the IRS. Financial projections should closely align with a company’s goals and objectives.

This is the reason a majority of small business owners either hire accountants to compile financial statements or use an accounting software for efficient recordkeeping. At QuickBooks, our business accounting software is accountant for freelancers intuitive and easy to use, to ensure you can achieve these tasks with ease. From managing your taxes to generating financial reports, our business accounting software can make running your business easier than ever.

A separate bank account makes it much easier to have a clean record of business transactions. Get your small business on track and move forward toward the goals and financial objectives you have for your company with business accounting principles. The Introduction to Financial Accounting from UPenn will help you learn how to read the three most common financial statements (income statements, balance sheets, cash flow statements).

You can research this on your state government’s website, and consult with your CPA. Before adding anyone to your payroll, make sure your workers are categorized correctly as either employees or independent contractors. Just like a regular bank, every payment provider will have a different fee structure. Before you commit, make sure you do the math to determine the impact a provider’s fees will have on your bottom line.

This allows you to generate crucial financial statements, such as a balance sheet, cash flow statement, and profit and loss report. It sounds simple, but in reality, a lot of behind-the-scenes work goes into accurately reporting on a business’s financial state. Another way accounting and bookkeeping differ is that accounting is a broader field that covers a more comprehensive range of topics. https://www.accountingcoaching.online/ You may be responsible for tax planning, financial statement preparation, and auditing as an accountant. On the other hand, bookkeepers are typically only responsible for recording transactions and keeping track of financial data. Small businesses may benefit from an accountant as the company grows and the need for more financial tracking, recording, forecasting, and budgeting accrues.

Read this guide to discover financial reporting and the different accounting systems, accounting software, and whether you can do your own small business accounting. When you’ve just started and have limited funds, you might consider handling your accounting activities yourself. However, once the business has sufficient discretionary funds, it’s best to outsource these tasks to an accountant or a bookkeeper. Based on the monthly sales, set aside some money to pay for your taxes.

Other features you may want to consider include whether the software has a mobile app, how good its customer service is and how well it does with accounts receivable (A/R) and financial reporting. Key accounting best practices for small businesses include keeping businesses’ finances separate from personal finances, maintaining accurate records, and tracking income and expenses. Small businesses may also want to consider hiring professional accountants or automating their finances with accounting software. While accounting may not be what motivates you to go to work every day, it’s a part of the job.

The Ascent is a Motley Fool service that rates and reviews essential products for your everyday money matters. Xero starts at $9/month for the Early plan, though most small businesses will find the Growing plan, at $30/month, more suitable. If you absolutely want to be connected with hundreds of apps that offer hundreds of tasks, Xero may be right for you. A great fit for e-commerce startups and small businesses, Xero has added a ton of features in recent years, and it offers excellent integration across the board.

One of the most critical aspects of accounting for small businesses is managing expenses. It’s not a separate entity from you, so your bank account doesn’t need to be either. For example, freelancers and contractors may not have payroll duties, whereas larger businesses do. With the help of good software, accounting for a small business can be much easier than you think. No matter your situation, here are some good choices to get you started. If you’re using accounting software, the accounting cycle is automated, reducing the number of steps drastically.

The most critical factors in your decision on accounting software for your small business are determining which features you need and how much you’re willing to spend. Accountants communicate financial information, which can be a powerful tool for making business decisions. If you run or manage a business or are looking for jobs in an accounting department, you must understand accounting and accounting terminology. If you’re not totally sure what bookkeeping entails, read our guide on the difference between bookkeeping and accounting.

You can skip the hassle of manual reconciliation with small business accounting software, which automatically pulls through your bank records. In the early days, you might find it helpful to have a small business accounting checklist. Once you’re in the swing of things it’ll be easier to keep on top of your responsibilities, because you’ll know what needs to happen at certain times during the month. Bookkeeping is concerned with recording and organising financial data.