12 Best Cloud-Based Accounting Software of 2024

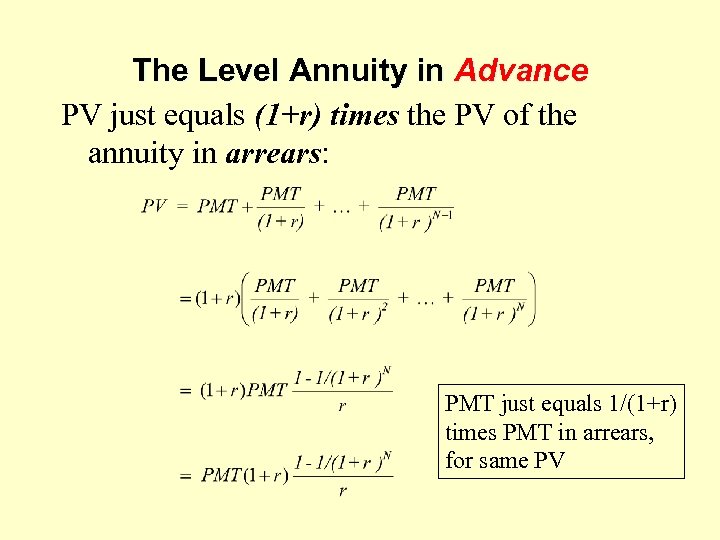

Check out the Xero App Store to find, try and buy business apps that connect easily to Xero online accounting software. Apps like Stripe, GoCardless, Shopify, and WorkflowMax connect seamlessly and sync data with Xero business accounting software. An ideal solution is to have a standard payroll app coupled with a financing app, interest rate/loan calculator, and a report generator for the audit client. Small businesses often experience growing pains, which makes choosing software with future growth in mind a priority for many. Cloud accounting software allows businesses to purchase what they need and increase their spend as they grow. This includes adding more storage space, users, and more advanced features.

- Extensive research is also needed to determine what the target audience wants.

- However, cloud accounting has fixed the issue, thanks to the remote server access.

- Users can access the software applications via the internet or other networks via a cloud application service provider.

- Pulling data from our opportunities in sales and analyzing what the forecast is going to look like for revenue over the next 12 months is hugely critical for us.

- Companies also receive points based on other resources available, such as self-help articles and user community.

Why cloud accounting is good for business

Nothing stays the same forever and everyday new technologies are being developed that will impact the future of Canadian small businesses. From the help of AI to continued integrations, the future of cloud-based accounting systems has never https://www.quick-bookkeeping.net/ looked brighter. Retail operations electronically enter transactions as they occur, whereas you might only enter your transactions at the end of each week or every other week, depending on the size and sales volume of your business.

Why should you move to cloud accounting?

We appreciated Intacct’s sophisticated general ledger, which includes a multidimensional chart of accounts. This feature helps manage intricate financial operations across multiple entities, best for international organizations. The real game changer is the ability to merge data, manage currency conversions, and generate consolidated reports without waiting for month-end closings.

Improved data security:

It also has a built-in email feature that lets you send invoices and other documents, instead of sending them via your personal email. You can’t invite your bookkeeper directly as an accountant user, but you can add them as a collaborator in the paid plan and then choose the level of access you wish to grant them. Wave offers a free plan (Starter) for accounting and invoicing and a paid plan (Pro) for $16 per month when billed monthly or $170 per year when billed annually. The paid version includes additional features, such as unlimited user access, unlimited receipt scanning, and bank feeds.

The key difference is that cloud accounting software is not installed on any one computer, but rather, it’s stored in the cloud and accessible through a remote user portal. Because of this, accounting teams don’t have to work in the same physical space. In fact, they don’t need a physical office at all, which means they don’t need the office equipment. To start off, let’s go back to the basics and define a cloud-based accounting system. It’s a method of accounting in which the firm is able to perform its work on a secure remote server.

Work smarter with accessible data in the cloud

That includes the chart of accounts, invoices, bills, contacts and fixed assets. For a smooth transition and best results, we recommend working with an accountant or bookkeeper, preferably one with Xero experience, when you make the move to Xero cloud accounting software. Several aspects of your day-to-day business operations, like managing inventory, invoices, payroll, and even portions of your customer relations management can all be tied into your cloud accounting software. Whereas only one person has user access in the traditional accounting software model, the cloud accounting software is equipped with multi-user access which allows you to collaborate with your team and advisors online. An ideal accounting tool for service-based small businesses and freelancers, Wave allows you to send simple invoices, generate financial reports, track receipts, organize your income, expenses, payments, and invoices. You can use cloud-based software from any device with an internet connection.

Put simply, a “gateway” that allows different pieces of software to connect with each other. In the case of cloud accounting, an API is necessary to connect third-party software. If you’re still getting your head around the jargon of cloud accounting, here’s our breakdown of some common terms.

Collaboration has always been an issue in remote work setups – especially for accounting teams. However, cloud accounting has fixed the issue, thanks to the remote server access. Firms, clients, and employees can collaborate when the accounting operations are run on the cloud. Everyone with an internet connection can access the data files, make changes to them, and update the files.

Log in via a web browser from your laptop, or use your provider’s mobile app to access your accounts from your phone or tablet. Recording the income and expenditure of your small business to keep track of your historical financial performance is nothing new. Double-entry bookkeeping has been around for centuries and accounting software has existed for decades, giving finance teams the ability to record and track the https://www.accountingcoaching.online/what-is-a-contra-expense-account/ money coming into, and out of, the company. In the event of a natural disaster or fire, being in the cloud means business productivity doesn’t need to be affected because there’s no downtime. As long as you have access to any computer or mobile device connected to the internet, you’re back up and running. Xero and FreshBooks are frequently highlighted for their user-centric design and intuitive functionalities.

Further, the program is secure, as it uses advanced industry-recognized security measures, such as SSL encryption, password-protected log-ins, and firewall-protected servers. For those who often work on the go, you’ll appreciate its mobile app which you can use to capture expense receipts, create and send invoices, and accept payments. Zoho Books is the cloud-based accounting what is fixed cost component of a larger suite of business solution tools. In addition to accounting software, Zoho offers more than 40 enterprise-level online applications to grow sales, market your business, communicate with teammates, provide customer service and more. Businesses that need an integrated business ecosystem will have a hard time finding a more robust business suite.

Meetings to revalidate business processes based on upgrades, which were required previously, were no longer necessary. Instead of each employee working on the same software, but installed separately on each of their computers, cloud accounting allows you all to access the same system, and share data with colleagues and clients with ease. This works a lot like the package deals vertical app markets currently offer, but with a more customized approach that allows the user to build a cloud-accounting solution specifically for their business. Another way artificial intelligence can help sort a company’s books are with long-range and specific predictions about which customers, clients, or markets are more trouble than they’re worth.

Its entry level plan is affordable, though it’s best suited to freelancers, solopreneurs and small businesses since it only allows 20 invoices and 5 bills per month. Other features include financial reporting, project and time tracking, documentation management, expense management and payroll acceptance. Cloud accounting refers to the practice of using internet-based software hosted on remote servers to manage financial transactions, accounting, and bookkeeping activities. Unlike traditional accounting software installed on a local system or computer, cloud accounting operates online.

Xero provides multiple layers of protection for the personal and financial information you entrust to Xero accounting software. Security is a priority for Xero, as we know it is for you, so it’s also important you also take steps to safeguard your data. As Canadian firms take in ever-increasing volumes of data, a sorting mechanism must be employed to make sense of it and draw reasonable conclusions. This has obvious applications for up-and-coming small businesses, as well as for Canadian firms looking to compete abroad in a post-USMCA trading environment.

With most cloud-based accounting programs, you can automate your workflow to save time. For example, you can enter your vendor information and set up a workflow that automatically pays that vendor on the same due date every month. You can also automate sending out invoices to your recurring customers. Cloud-based accounting works by using secure web-based software to help streamline business processes. Small business owners and their finance teams can access all key data from their locations, making collaboration and financial reporting easier.

Wave Accounting is a free cloud-based accounting app that handles unlimited transactions, multi-currency invoicing, and bank and credit card connections. Another option is ZipBooks, which offers a free starter plan that includes basic invoicing, bookkeeping, and the ability to manage unlimited vendors and customers. Additionally, when you upgrade to the paid option, you can set up as many users as needed, and everyone can access the software simultaneously.